The onboarding flow for any financial platform is where security, compliance, usability, and trust converge. For Uphold Login—an access point designed to accommodate retail users, advanced traders, and institutional customers—the flow must balance low friction with rigorous identity verification and fraud prevention. The journey begins from the moment a prospective user arrives at the landing page and presses the "Sign up" or "Log in" control. Every decision in the flow, from the initial information requested to the presentation of security prompts, influences conversion rates, regulatory risk, and the subsequent quality of user interactions on the platform.

At its essence, the Uphold onboarding flow is composed of several sequential and sometimes overlapping stages: discovery and account initiation, identity verification (KYC), authentication hardening, funding and payment-linking, behavioral risk assessment, and the final entry into an account that reflects appropriate product access based on jurisdiction and risk profile. Each stage includes both a frontend UX element that the user experiences and backend checks that occur invisibly: API calls to identity providers, biometric liveness checks, sanction screenings, and device signals used for risk-based decisioning. Understanding both the visible and invisible parts of the flow is crucial to appreciating the platform’s operational posture.

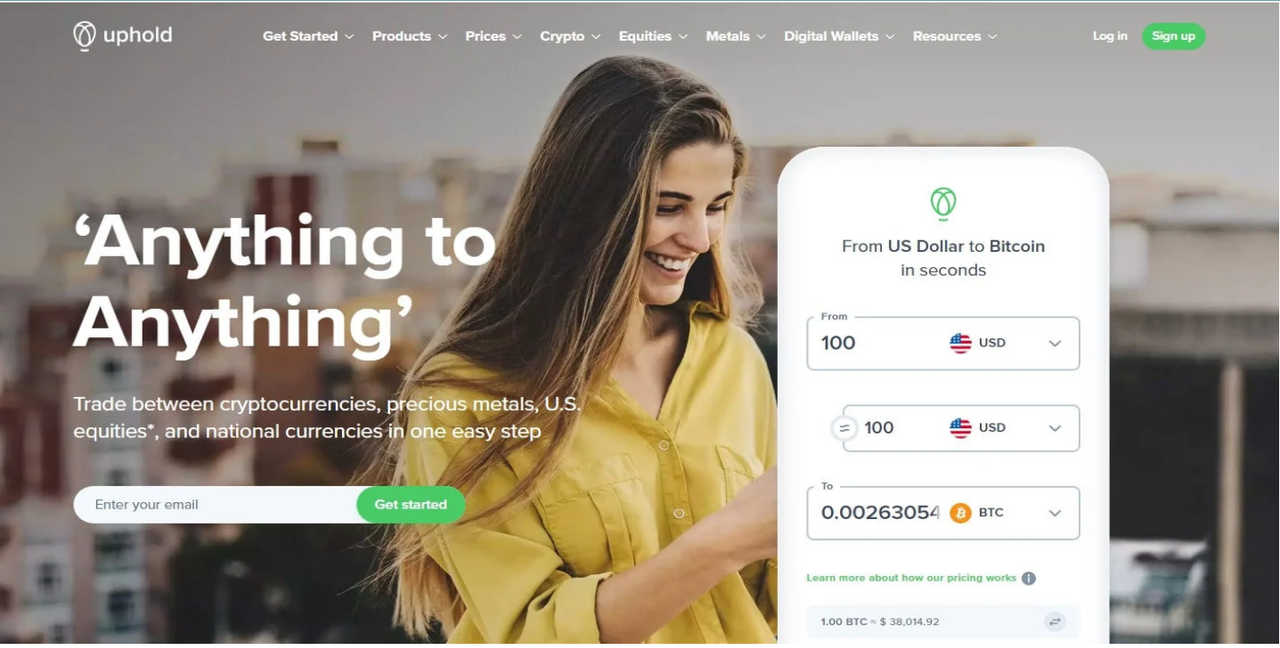

The first step—account initiation—prioritizes simplicity. Most users prefer minimal up-front friction, so Uphold typically asks for an email address and a password or will present social sign-on options where regulatory requirements permit. The design tradeoff is explicit: allow an easy entry that encourages trial use, but delay high-privilege operations until identity verification completes. For many users, Uphold implements progressive disclosure: basic features (market data, educational content, or demo modes) may be available immediately, while deposits, trading, and fiat rails open only after identity proofing. This staged access reduces initial abandonment while keeping regulatory exposure controlled.

Identity verification is the next and most compliance-sensitive phase. Uphold, like many regulated financial services, relies on third-party identity verification providers alongside in-house checks. Users are asked to provide government ID, a selfie for biometric comparability, and sometimes proof of address. The onboarding flow guides users through acceptable document types, captures high-quality images using device camera APIs, and employs liveness detection to reduce spoofing attempts. These visual and algorithmic controls are paired with database screening—watchlists, PEP (politically exposed persons) checks, and adverse media—to provide a composite risk score. The platform's decision logic may automate approvals for low-risk users and escalate higher-risk applicants to manual review by compliance analysts.

Authentication hardening is a parallel track. Uphold encourages or mandates multi-factor authentication (MFA) options: time-based one-time passwords (TOTP), SMS (where allowed), and hardware-backed authentication using FIDO2/WebAuthn for passwordless sign-in. The flow often nudges users toward stronger options—explaining the benefits of hardware keys or authenticator apps—because MFA significantly reduces account takeover risk. Device recognition and cookie-based session tokens are commonly used to support a smooth experience on recognized devices while requiring fresh authentication on new devices or after high-risk events. Risk-based authentication further adapts the challenge level: a low-risk login from a known device may require only a password and device token, whereas a high-risk login triggers biometric verification or temporary withdrawal locks.

Funding and payment-linking form a practical onramp to economic activity. Uphold’s onboarding includes flows for linking bank accounts, verifying cards, and adding cryptocurrency deposits. These steps involve micro‑deposits, bank login integrations (e.g., through Plaid or similar), or instant card verification. The UX emphasizes clear explanations of hold times, limits, and fees to set expectations. For corporate or institutional customers, the payment linking process includes additional compliance checks—beneficial ownership collection, corporate documents, and bank reference verification—and often a human touch via an account manager to expedite onboarding while ensuring policy adherence.

Behavioral risk assessment and fraud prevention operate behind the scenes at nearly every touchpoint. Uphold aggregates device signals, IP reputation, proxy detection, velocity checks (how many accounts created from the same IP or device fingerprint), and patterns that resemble automated account creation. When anomalies are detected, automated workflows can quarantine the account, require manual review, or apply temporary limits. Transparent messaging is key: informing users why an action is paused and how to resolve it reduces frustration. For legitimate users flagged by false positives, efficient appeals and human review are essential to maintain trust and reduce churn.

Consent, disclosure, and legal acknowledgments are embedded into the onboarding experience. Regulatory frameworks across jurisdictions require explicit consent for data processing, disclosures for investment products, and acceptance of terms of service. Uphold surfaces these documents contextually—using clear, scannable summaries—while preserving the legal text in full. For cross-border customers, the flow adapts to local rules: some features may be disabled based on residency, and additional tax or AML disclosures are collected where necessary. The dynamic mapping of product availability to the user’s verified jurisdiction prevents accidental regulatory violations and shapes the user's expectations about available services.

Session management, recovery, and account lifecycle are often overlooked but are critical to both security and user experience. Uphold’s onboarding includes guidance for account recovery—trusted contacts, recovery codes, and verified email/phone channels—while reminding users that certain high-privilege account recoveries may require additional identity proofing. The platform also presents options for device management: listing active sessions, revoking device access, and setting session timeouts. For institutional customers, multi-user access controls and role assignments are introduced during onboarding so that treasury staff can operate with appropriate privileges and audit trails from day one.

Developer and partner onboarding deserves its own flow. Uphold exposes APIs and partnership programs that require separate identity verification and contractual agreements. API clients receive keys with scoped permissions and must pass security assessments. For wallets, exchanges, or fintech partners that integrate Uphold Login via OAuth or SSO, the flow establishes scopes, consent flows, and token refresh strategies. Ensuring a secure, well-documented partner onboarding experience reduces integration errors that could otherwise surface as security incidents.

Accessibility, localization, and usability optimize the onboarding experience for diverse users. The platform implements localized language support, accessible form fields, and alternative verification routes for users with limited document availability. UX choices—such as inline validation, helpful microcopy, and progress indicators—reduce friction and increase completion rates. For high-volume customer segments, a blended approach combining automated verification with human-assisted onboarding accelerates throughput while maintaining compliance quality.

After onboarding, monitoring and continuous improvement close the loop. Uphold analyzes drop-off points, conducts A/B tests on form layouts, and refines the verification heuristics to balance false positives and detection rates. Regulatory change management—keeping up with AML rules, sanctions lists, and privacy directives—requires mapping legal updates into the onboarding logic and retraining models. A mature onboarding program is therefore not static; it evolves with threat landscapes, product expansions, and jurisdictional obligations.

In summary, the Uphold Login onboarding flow is a carefully orchestrated sequence that starts with minimal barriers to entry and incrementally increases assurance through identity verification, authentication hardening, payment onboarding, and risk-based controls. It marries user-centric design with regulatory rigor and adaptive security so that legitimate users can onboard quickly while malicious actors are detected and mitigated. For product teams, the lessons are clear: prioritize clarity, provide staged access, invest in robust identity and device signals, and ensure humans can intervene efficiently when automation flags uncertainty. For users, the path is equally straightforward—follow the instructions, choose strong authentication, and secure recovery options to turn an initial login into a resilient gateway for financial services.

Author's note: This continuous guide synthesizes product design, compliance, and security practices to explain how a modern finance platform like Uphold approaches onboarding. It is informational and does not replace platform-specific documentation or legal counsel.